Forget everything you thought you knew about retail in Saudi Arabia. The market isn't just recovering; it's undergoing a seismic revolution. A staggering SAR 1.41 trillion (US$376 billion) in consumer spending in 2024 is just the headline. The real story is how and why this spending is happening.

Beneath the surface of this 7% year-over-year growth, a fundamental transformation is underway, powered by Vision 2030's ambitious goals to diversify the economy and enhance the quality of life. This isn't about building bigger malls; it's about creating entirely new, experience-driven ecosystems.

Based on the latest Saudi Arabia Retail Market Overview for Spring 2025, here are the five tectonic shifts reshaping the Kingdom's retail landscape.

1. The Digital Tsunami: Clicks, Cards, and "Phygital" Dominance

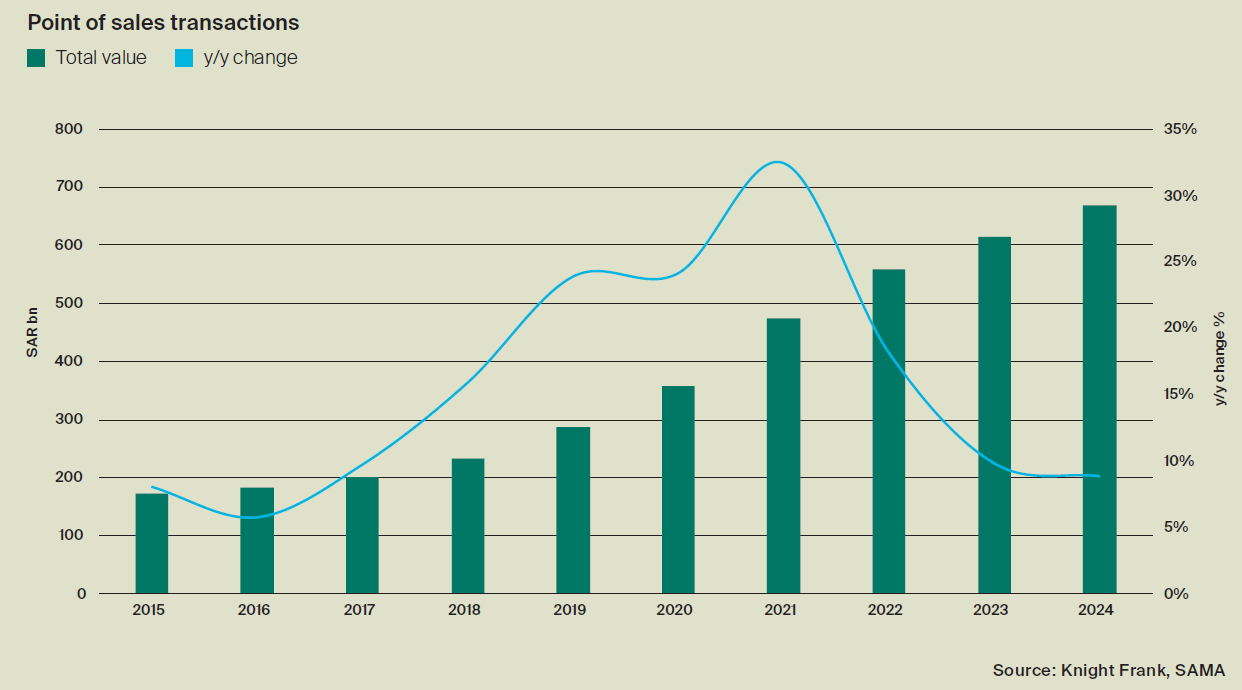

The line between a physical store and a digital app has officially been erased. While Point-of-Sale (POS) transactions hit an impressive SAR 668 billion, the real headline is the meteoric rise of e-commerce, which surged 26% to reach SAR 197.4 billion.

This isn't just about online shopping. Digital is woven into the very fabric of the retail experience.

• E-retail now accounts for nearly 40% of all POS transactions, a testament to the rapid pace of digital adoption.

• "Buy Now, Pay Later" (BNPL) is booming, with local giants Tabby and Tamara commanding a 95% market share by offering Shariah-compliant, zero-interest solutions that are integrated everywhere.

• New retail developments are being built with flexible layouts and features like "click-and-collect" zones to merge the online and offline worlds seamlessly.

2. The Experience Economy is the New Anchor Tenant

The most valuable commodity in Saudi retail today isn't a product—it's an experience. Developers are no longer just leasing space; they are curating destinations.

The numbers are telling: in 2024, nearly 30% of all POS spending—a massive SAR 198.6 billion (US$53 billion)—was at restaurants and cafés. This highlights a profound shift where food and beverage, entertainment, and leisure are the true anchors.

Across the Kingdom, the focus is on:

• Lifestyle-Oriented Spaces: Upcoming projects are defined by their lifestyle and entertainment offerings, designed to increase dwell times.

• Entertainment Integration: More than half of the upcoming projects in Riyadh are incorporating entertainment zones and cinemas.

• Global F&B Brands: High-end dining experiences are flooding the market, with names like Zuma and Sexy Fish setting up shop to cater to a sophisticated palate.

3. Riyadh: The Undisputed Engine Room of Growth

Riyadh is the vibrant epicenter of this retail resurgence. The capital is not just leading; it's setting the pace for the entire nation.

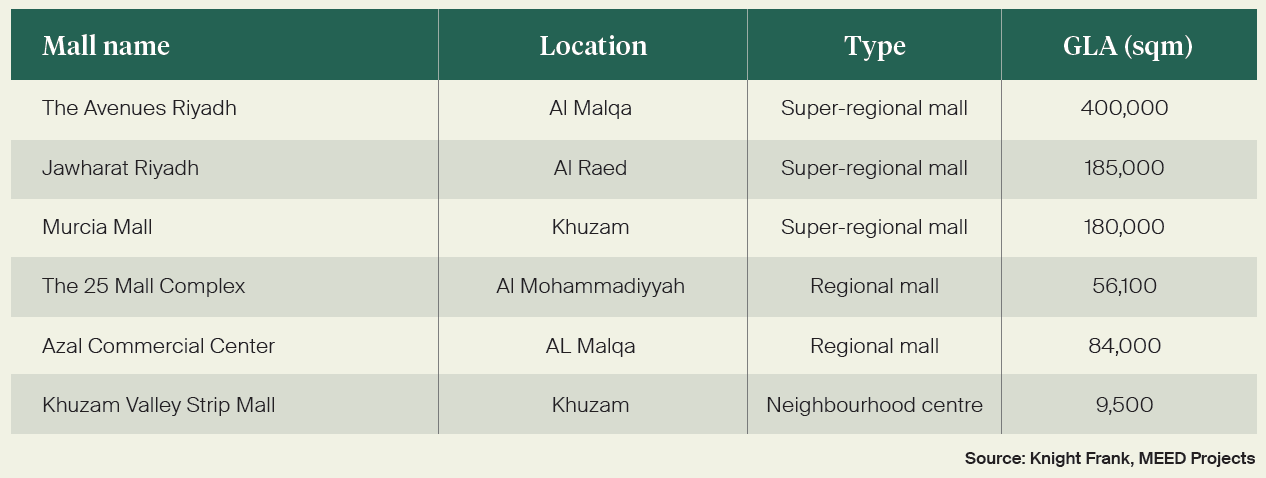

• Unprecedented Development: Riyadh accounts for 2.2 million sqm of the 4.9 million sqm of new retail development planned for the Kingdom's five largest cities by 2030.

• Soaring Performance: In the 12 months leading up to Q1 2025, prime mall rents climbed 4% to SAR 2,848 per square meter.

• Packed Houses: City-wide retail occupancy has risen by 5 percentage points to a robust 92%, driven by demand for flagship destinations.

Mega-projects like The Avenues Riyadh and Jawharat Riyadh are poised to further transform the city's landscape, cementing its status as the primary retail hub.

4. The Magnetic Pull of Luxury

As part of Vision 2030, Saudi Arabia is strategically positioning itself as a world-class luxury destination. The goal is to attract not only affluent tourists but also leading global brands looking for their next growth frontier.

The strategy is already bearing fruit:

• Global Brand Expansion: Prominent international brands like Gucci, Hackett London, and Steve Madden have recently expanded their footprint in the Kingdom.

• Dedicated Luxury Hubs: Jeddah is set to launch Saudi Arabia's first dedicated luxury retail district with Jawharat Mall, an 87,000 sqm development featuring over 300 premium outlets.

• Waterfront Lifestyle: Projects like The Cove in Jeddah will blend luxury retail with a marina and scenic waterfront views, creating a holistic leisure destination.

5. A New Consumer Has Entered the Chat

Driving this entire transformation is a diverse and dynamic consumer base. This is not a monolith; it's a complex mix of tech-savvy youth, experience-seeking tourists, and budget-conscious families.

This modern consumer is savvy and sophisticated. While they are drawn to luxury and experiences, they remain value-driven, with a keen eye for promotional offers and affordable labels. They expect omnichannel convenience, blending the ease of digital platforms with the engagement of physical retail. This forces brands and developers to offer a balanced mix of affordability and premium experiences to win.

The Ripple Effect: Jeddah and Dammam

This transformation is not confined to the capital.

• In Jeddah, the retail market is expanding with 225,000 sqm of new space added in 2024. While this has intensified competition and caused occupancy in older malls to dip slightly to 86%, the city is doubling down on luxury and waterfront projects to carve out its unique identity.

• The Dammam Metropolitan Area (DMA) presents a picture of stability, with healthy occupancy of 90%. However, with a significant 484,400 sqm of new space anticipated by 2026, the pressure is on for existing retail centers to innovate and embrace the experiential trend or risk becoming obsolete.

The Takeaway

The story of Saudi Arabia's retail market is the story of a nation in hyper-drive. The convergence of rising digital literacy, massive infrastructure investment, and a strategic focus on quality of life is creating one of the most exciting and investment-ready retail environments in the world. The future is not just about transactions; it's about creating diversified, modern, and engaging experiences that resonate on a global scale.