Riyadh, Saudi Arabia - November 24, 2024: Nice One Beauty Digital Marketing Company, a prominent Saudi-based beauty and cosmetics e-commerce platform, has announced its intention to proceed with an initial public offering (IPO) and list its shares on the Saudi Exchange (Tadawul). The IPO will involve the listing of 34.65 million shares, representing 30% of the company’s post-IPO share capital.

Approved by the Capital Market Authority on September 25, 2024, the offering includes 29.1 million shares from existing shareholders and 5.55 million newly issued shares through a capital increase. Net proceeds from the IPO will be allocated to existing shareholders on a pro-rata basis, while the capital raised from new shares will be reinvested into enhancing the company’s working capital, expanding its logistics and technical capabilities, and developing proprietary brands and sales channels.

A maximum of 34.65 million shares, representing 100% of the offering, will initially be allocated to institutional investors during the book-building phase. Up to 10% of the shares (approximately 3.47 million) may subsequently be allocated to retail investors, contingent on demand. The final offering price will be determined following the conclusion of the book-building process.

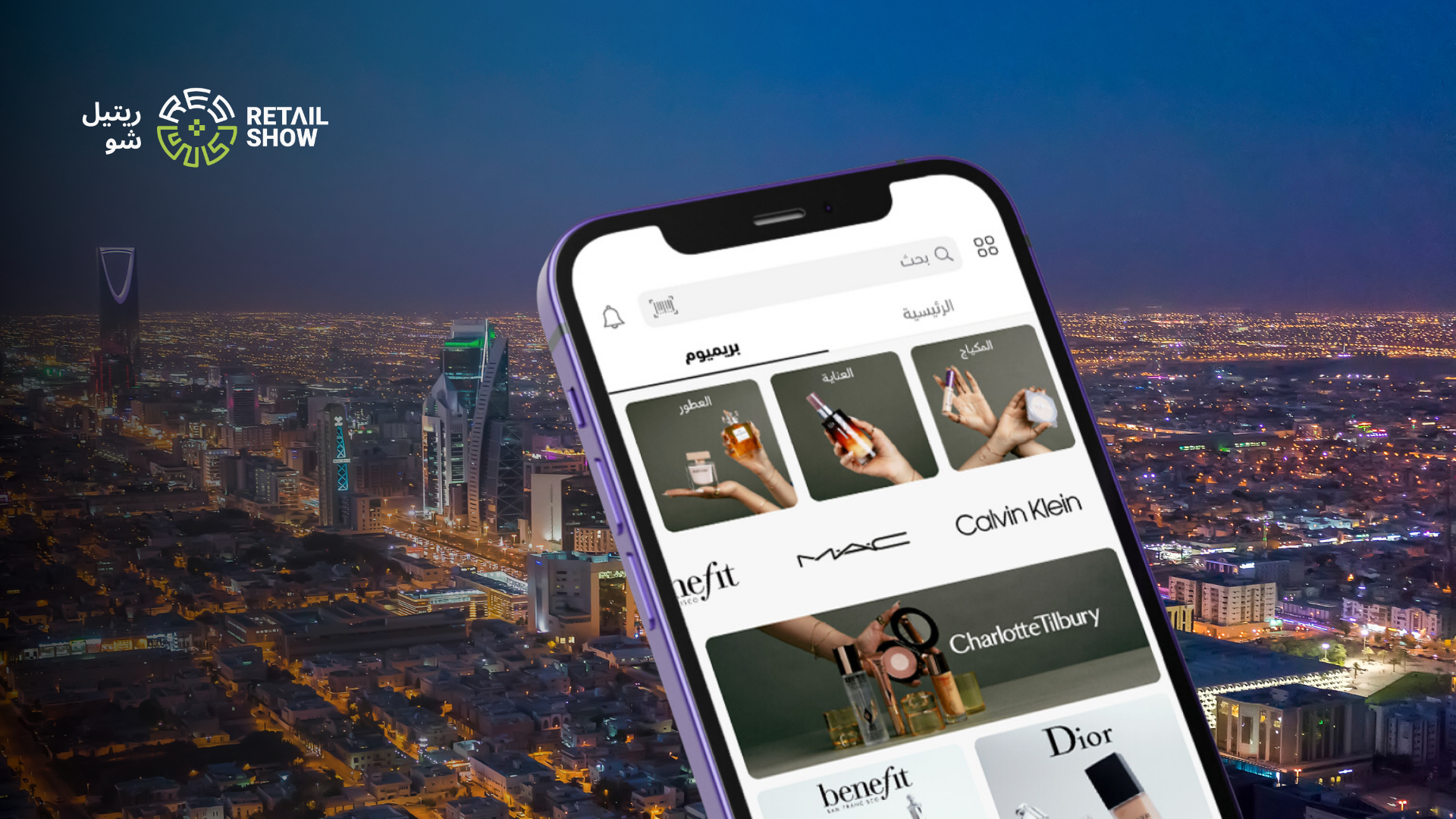

Founded in 2017, Nice One has established itself as a leading e-commerce platform in Saudi Arabia's beauty and personal care sector, offering products across cosmetics, skincare, haircare, perfumes, lenses, and even nutritional supplements. The platform features over 28,000 products and partnerships with 1,200 leading international and local brands, alongside its own private-label offerings.

In 2023, Nice One reported revenues of SAR 782.4 million, a 61.2% year-on-year growth in Q1 2024, and EBITDA margins climbing to 10.2%. With over 40 million units sold in three years and a 90% customer satisfaction rate, the company demonstrates strong operational efficiency and customer loyalty.

In an official press release, Omar Alolayan, CEO & Co-founder of Nice One, said, “This IPO marks a significant milestone in Nice One’s journey. It reflects the dedication and hard work of everyone involved since we founded the company in 2017. Over the years, we have transformed Nice One from a startup into the largest e-commerce platform for beauty and personal care in Saudi Arabia.”

“We have consistently innovated and adapted, scaling the business in a dynamic marketplace by offering cutting-edge digital solutions and personalized experiences. As we move forward with our IPO, we are excited to further expand our reach, invest in digitalization, and continue delivering world-class products and services to our customers. We have a clear strategy aligned with Vision 2030, and I am confident that, with our collective expertise and market insight, we are entering a promising future.” he added.

In respect to the Offering, the Company has appointed EFG Hermes KSA and SNB Capital Company as the joint financial advisors, bookrunners, and underwriters. SNB Capital will also act as the lead manager.

The IPO marks a transformative chapter in Nice One's journey, underscoring its rapid growth and leadership in Saudi Arabia’s beauty e-commerce market. By utilizing raised capital to enhance operations, expand offerings, and align with Vision 2030, the company is well-positioned for long-term success, signaling a bright future for investors and customers alike.