We are delighted to present a Q&A session with Avanthika Satheesh, the Director of Emerging Technologies at Customized Energy Solutions, MENA. With over 12 years of experience in the Energy and Power Systems sector, Avanthika has played a pivotal role in market research and strategic consulting for top multinational companies in the Energy Sector in India and APAC. Her interests span energy storage, battery manufacturing, EV charging, and renewable power. In this questionnaire, Avanthika shares invaluable insights into the Middle East's unique advantages in the global hydrogen market, shedding light on resources, geographic positioning, and the significant investments driving the region's emergence as a hydrogen powerhouse. She also delves into the role of the Middle East in transitioning towards green hydrogen, its impact on energy dynamics, and global sustainability efforts. Additionally, Avanthika provides an overview of hydrogen production technologies in the Middle East, their sustainability, and scalability. Lastly, she explores the challenges Middle Eastern countries face in shifting to hydrogen-centric economies and discusses how they can leverage their strengths to establish themselves as frontrunners in the hydrogen industry.

#WHF: What unique advantages does the Middle East hold in terms of resources, technology, or infrastructure that positions it as a pivotal player in the global hydrogen market, attracting investments from across the globe?

#Avanthika Satheesh:

Resources: The Middle East region is blessed with renewable resources such as solar, and wind, and conventional energy resources such as oil & gas. CES estimates that the installed Solar capacity in the Middle East region would be over 180GW, and wind capacity to be around 35 GW by 2030. The region generates electricity from solar power at the lowest tariff of US₵ 1.04/kWh (600 MW Al Shuaiba PV IP project). The levelized cost of generation of green hydrogen from the region is expected to be US$5-6/kg, while that of blue hydrogen is US$1-2/kg.

Geographic positioning: The region is strategically positioned to supply hydrogen molecules over pipelines to Europe and through ships to the Far East and other parts of the world. While the demand exists, strong policy push and subsidies are expected to drive the demand for hydrogen in domestic and international markets. For eg. Japan and S. Korea have announced subsidies effective from 2024-25, to cover the cost gap between low-carbon and fossil-based Hydrogen. Japan's government will be allocating US$20Bn over 15 years for domestic and imported H2.

Investments: There is a strong political motive driving investments into hydrogen projects in the region, as hydrogen is expected to strongly influence the future of energy trade globally. There are over 55 low-carbon hydrogen production projects announced in the region in the last 3-4 years. Most of these projects are in the Kingdom of Saudi Arabia (KSA), Oman, and Egypt. By 2030, the Middle East is expected to produce nearly ~18 million MT of green & blue hydrogen. Presently, the projects that have reached the Final Investment Decision amount to around US$45-50 Billion.

#WHF: Considering your experience and insights, how do you perceive the role of the Middle East in transitioning towards green hydrogen, and what impact might this have on the region's energy dynamics and global sustainability efforts?

#Avanthika Satheesh: Among the 61 H2 projects announced in the region(IEA, Project database, 2023), over 41 of them are aiming to generate green hydrogen. Green hydrogen depends on solar, wind, and energy storage technologies to power the electrolyzers to split water to generate H2 molecules. Presently, the region has the world’s lowest solar tariffs from 600 MW Al Shuaiba PV IP project at US ₵1.04/kWh, Al Dhafra solar park at US₵ 1.32/kWh, etc. In calculating the Levelized Cost of Hydrogen (LCOH) production, electricity cost contributes to around 60%, which makes the Middle East region the most attractive for green hydrogen generation.

Therefore, to meet the announced Green H2 projects, several renewable projects involving solar, wind, and energy storage (to support the intermittency of renewable power supply) are expected in the region. Based on announcements, the renewable energy capacity additions in the regions are expected to cross over 210 GW by 2030, majorly pushed by the countries- KSA, Oman, UAE, and Jordan. This is a significant addition to the present ~30 GW of installed RE capacity.

In the Middle East, the average annual investment in fossil fuel supply was around US$ 100Bn during 2015-2022. To meet the net-zero emission targets the investments into fossil fuel need to be toned down to US$ 50 Bn annually. (IEA, World Energy Outlook 2022) and moved into the renewable sector. It is also forecasted that the annual energy export revenue from oil and natural gas from the region would shrink from US$ 900Bn in 2022 to US$ 650Bn in 2030 and further to below US$ 400Bn by 2050. Besides, low-carbon H2 production is to increase to 0.5 EJ by 2030.

By 2030, the EU, certain parts of Asia, and the Far East are projected to become net importers of hydrogen. For instance, the EU is likely to import up to 10 MT/a of GH2 by 2030. The Middle East North Africa, Southern Africa, Australia, and the Americas will be net exporters of low-carbon H2 molecules.

#WHF: Could you provide an overview of the current landscape of hydrogen production technologies being utilized in the Middle East and discuss their sustainability and scalability, especially in the context of the region's energy goals?

#Avanthika Satheesh: Presently, grey Hydrogen constitutes over 95% of the hydrogen consumption in the Middle East. Steam Methane Reforming is the popular method used for grey H2 production. Over 55 new projects based on Green and Blue hydrogen are planned for production from the region.

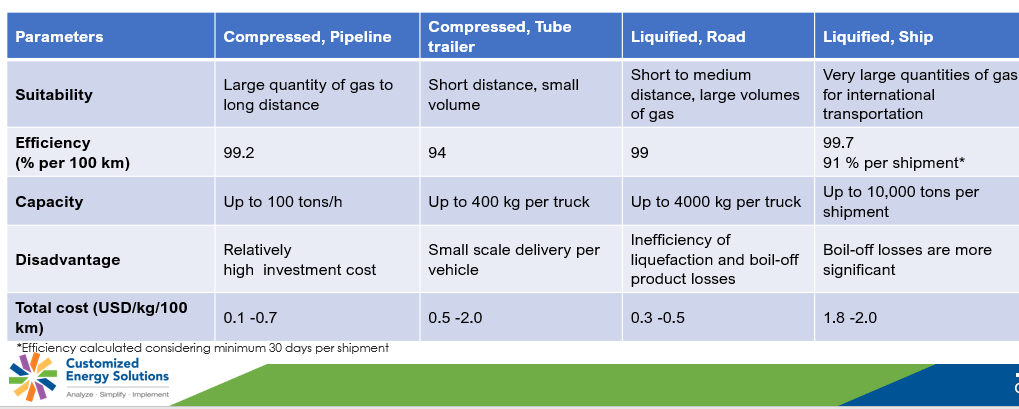

2023 was an exciting year in terms of several notable announcements on technological collaborations in the hydrogen sector in the Middle East region. Some of the notable announcements are that of technology acquisition or Joint ventures for the manufacturing of electrolyzers in the region.

Table 1: Notable Technology Announcements in the Hydrogen Sector in the Middle East

Electrolyzers of Alkaline, Bipolar ion exchange membrane, and Proton Exchange Membrane types are planned for usage in the upcoming green Hydrogen projects in the region. These technologies are mature and ready for commercial production and therefore scalable.

A comparison of various electrolyzer technologies is given in Figure 1 for reference.

Figure 1: Comparison of Electrolyzer Technology Parameter

Note: AEM: Anion Exchange Membrane, PEM: Proton Exchange Membrane, SOEC: Solid Oxide Electrolyzer Cell.

#WHF: Given the shift from fossil fuel economies to hydrogen-centric ones, what challenges - be they geopolitical, economic, or infrastructural - do Middle Eastern countries face, and how might they leverage their strengths to overcome these hurdles and establish themselves as frontrunners in the hydrogen industry?

#Avanthika Satheesh: Backed by strong fossil fuel resources and low cost of solar power generation the Middle Eastern countries took upon the ambitious green and blue hydrogen targets. To overcome technological challenges, acquisitions, joint ventures, and tech investments were initiated few of which are listed in Table 1. The UAE and Oman are planning to enter the manufacturing of electrolyzers in the region. (mentioned in response to Q3).

Presently, the region has the lowest cost of production of blue H2 at US$1-2/kg. Carbon capture is a key technology. The region has also invested in new Carbon capture technology in the recent past.

- 44.01 is a company with Carbon Capture technology presently conducting a pilot project in Fujairah, funded by ADNOC and in Oman. Using Direct Air Capture technology CO2 is captured from the atmosphere and mixed with Seawater and injected into peridotite rock formations underground and left to mineralise in about 10-12 months.

- 1PointFive is a Carbon Capture technology company from Texas planning to set up pilot projects on the Gulf Coast.

A few other CCU projects are being planned or constructed in Oman (Omifco), Qatar (Qatar Petroleum), and UAE (TA’ZIZ Blue Ammonia project).

Infrastructural challenge: To address the infrastructural challenges to meet the domestic demands, new pipelines are required to be laid and gas pipelines have to be repurposed for hydrogen transmission within the region.

Export: Europe is geographically close to the MENA region. There are existing gas pipelines between the MENA- EU regions.

- In the EU region, the European Hydrogen Backbone initiative will be repurposing the existing gas pipelines for H2 transmission, along with the addition of new pipelines. Around 33,000 km of pipelines are expected to be built at an investment of over €100 Bn Euro by 2030. In the short term, 5-10% H2 blended natural gas usage will be initiated in the EU for emission reduction. This doesn’t require any investment or modification of the existing gas pipeline system.

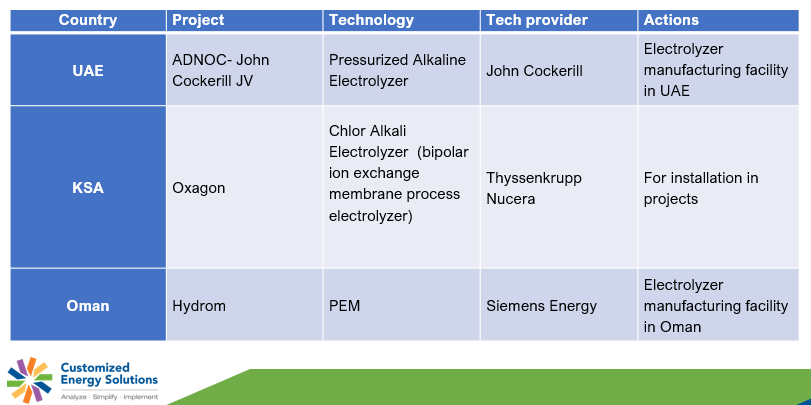

- Shipping of H2 to the Far East. Various H2 carriers and storage methods need to be evaluated to ensure the lowest cost of transporting the fuel across long distances to Far-Eastern countries. Various hydrogen transportation technologies are listed in Table 2, there is an additional US$0.5 to 2/kg cost for transportation

Table 2: Hydrogen Transportation Method Comparison.